-

Continue reading →: Cash Indices and Higher Time Frame Pullbacks

Continue reading →: Cash Indices and Higher Time Frame PullbacksIt reminded me of an old funny quote by trader Michael Burry. Post with Indicator here Futures and Cash Indices Index TradingView Ticker Hosted Source (Exchange) Based on Futures S&P 500 SPX CBOE ES (E-mini) Nasdaq 100 NDX NASDAQ NQ (Nasdaq) Dow Jones DJI DJ (Dow Jones Indices) YM (Dow…

-

Continue reading →: Mapping “The Dip”: A Visual Tool for Long-Term Investors

Continue reading →: Mapping “The Dip”: A Visual Tool for Long-Term InvestorsTechnical Details This indicator plots horizontal drawdown levels projected into the right-hand margin. It calculates percentage drops from a selected anchor point (ATH or Current Price) to identify key price levels. Technical Features Custom Options Explained 1. Reference (refMode) 2. Right Offset (bars) 3. Percentage Band Toggles 4. Color Inputs…

-

Continue reading →: 📈⛩️🗡️Trade Like a Samurai Scroll IV: Always In

Continue reading →: 📈⛩️🗡️Trade Like a Samurai Scroll IV: Always InSummary ⚔️ The Way Is in Training The samurai had a saying: 道は稽古にあり (Dō wa keiko ni ari) — the Way is in training.All mastery comes from repetition of the basics — not to reach an end, but to refine awareness itself. Kihon (基本) is not a stage you pass…

-

Master Your Trading Edge: The Continuous Improvement Loop

Published by

on

Continue reading →: Master Your Trading Edge: The Continuous Improvement Loop

Continue reading →: Master Your Trading Edge: The Continuous Improvement LoopFor serious Price Action traders, true skill enhancement doesn’t happen by chance; it relies on a deliberate feedback loop. This structured process ensures correct thinking to improve your trading, where the output of each stage feeds into the next. Here is the essential five-step continuous improvement loop you must use…

-

Continue reading →: Always-In Indicator for TradingView

Continue reading →: Always-In Indicator for TradingViewThe Always-In indicator highlights bars on your chart to help determine context. It looks for: It is based off the work from Dr Al Brooks in the Brooks Trading Course. Even if you don’t use TradingView, you can see the source code. You can get AI to make it for…

-

Continue reading →: Four Contradictions That Hold Traders Back

Continue reading →: Four Contradictions That Hold Traders BackEvery trader hits a point where effort and progress stop matching. The charts look the same. Study hours increase. Clarity doesn’t arrive. When that happens, the cause is usually internal, not technical. For me, it came down to contradictions in how I thought about trading. I hope the points below…

-

Continue reading →: Understanding Brokers and Platforms for DAX and Gold Trading

I got a few questions from Australian traders so I thought I would do more of a deep dive here. It also applies to traders everywhere in terms of a decision process. Introduction On the one hand, trading is very simple: click a mouse button and you are in a…

-

Continue reading →: 📈⛩️🗡️ Trade Like a Samurai Scroll III: What Happens When Swing Points Break?

Continue reading →: 📈⛩️🗡️ Trade Like a Samurai Scroll III: What Happens When Swing Points Break?Summary In the past two posts we built a foundation around swing points in our price action trading. What to do when they break? In this next scroll we review possible trade setups and price action outcomes. Lets cut right in! Pre-Work 📜 See earlier scroll for Scroll I and…

-

Continue reading →: 📈⛩️🗡️Trade Like a Samurai Scroll II: HTF Swing Points

Continue reading →: 📈⛩️🗡️Trade Like a Samurai Scroll II: HTF Swing PointsSummary 📈⛩️🗡️ In the Trade Like a Samurai series, the focus is on Kihon (基本) — the martial fundamentals of trading discipline. For the samurai, Kihon was not separate from combat skill ⚔️; it was the edge of the blade itself. 🔍 In this Scroll II, I demonstrate deliberate-practice drills…

-

Continue reading →: 📈⛩️🗡️Trade Like a Samurai Scroll I: Swing Points

Continue reading →: 📈⛩️🗡️Trade Like a Samurai Scroll I: Swing PointsSummary 📈⛩️🗡️ In the Trade Like a Samurai series, the focus is on Kihon (基本) — the martial fundamentals that forge every trader’s skill. For the samurai, Kihon was not separate from combat skill ⚔️; Practised every day the Samurai became the skill. 🔍 In this first scroll, I demonstrate…

-

Continue reading →: Big Gap Up on the Weekly Chart

Continue reading →: Big Gap Up on the Weekly ChartPremise Weekly Gap Ups 27 October 2025 1 July 2019 24 April 2017 – Gap Up 48.75% 7 November 2016 – Gap Up 47.75% 3 January 2012 – Gap Up 41.5% Weekly Gap Downs 7th April 2025 – Big Gap Down 30.75% 3rd February 2025 – Big Gap Down –…

-

Continue reading →: Streaks Above and Below the Moving Average: MA Research

Continue reading →: Streaks Above and Below the Moving Average: MA ResearchMost traders use a moving average, but how many have studied the moving average itself and how to use it? I n the post below I explore some research ideas that have been useful in my trading and valuable for traders to explore. There is also an indicator below you…

-

Continue reading →: Researching CME Settlement vs RTH Close (E-mini S&P 500 Futures) and its Effect on Swing Targets

Continue reading →: Researching CME Settlement vs RTH Close (E-mini S&P 500 Futures) and its Effect on Swing TargetsThanks to my friend and trader Tim Stout for the great chat we had in Orlando regarding ES – Bar 78 vs Bar 81. (CME vs RTH Close.) It was never a focus of my research before, having worked on Bar 81 only. So a big thank you for that…

-

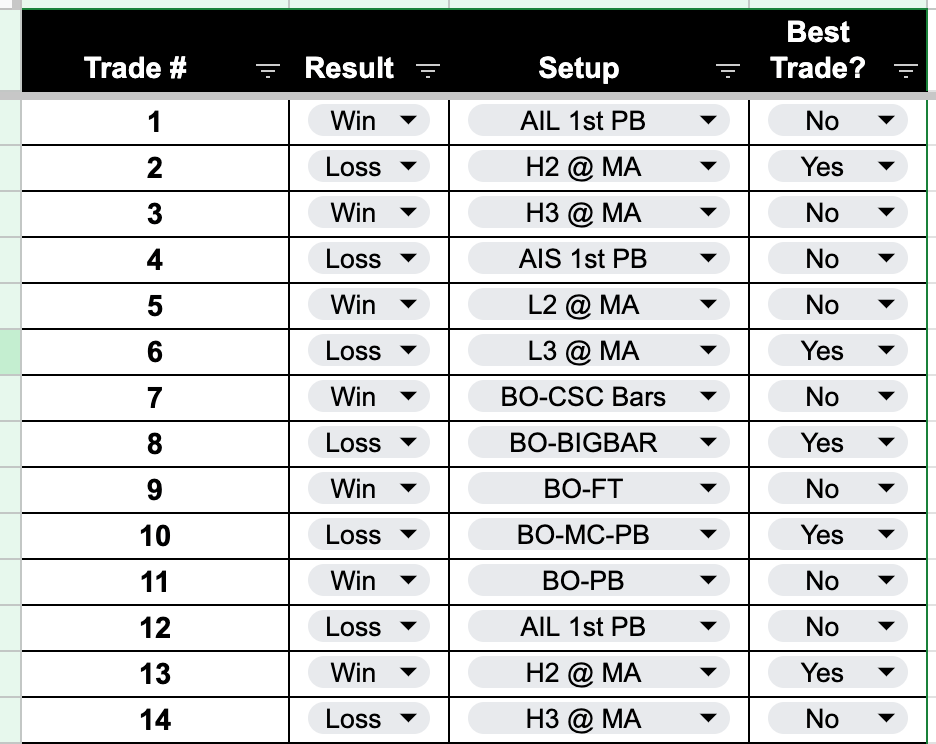

Continue reading →: Brooks Price Action Seminar – Workbook

Continue reading →: Brooks Price Action Seminar – WorkbookPlease find a workbook for today’s presentation: View Online (Click Save a Copy) https://docs.google.com/spreadsheets/d/1hChlLnojPUxGNYSVdwrOmIy_47q7_qAZAfexH0hwhuU/edit?usp=sharing Download .xls https://docs.google.com/spreadsheets/d/e/2PACX-1vQp5Q2NfQ8Zi5DfUbLuxrc0pp2hqbZLodJSFGvvLzGmj3-8Dn-O13eS3Rj1dvm0QWrxQufESLd0v3ah/pub?output=xlsx

-

Continue reading →: 7 Common Trade Mistakes and How to Fix Them

Continue reading →: 7 Common Trade Mistakes and How to Fix ThemEvery trader makes mistakes. The difference between an edge which survives the market and one that doesn’t is not the absence of errors, but being aware of where they show up. All of the below have haunted me from time to time. Being aware of them already improves my edge.…

-

Continue reading →: Practice Drills for Trading Ranges: Relief Bars, S/R and Gaps

Continue reading →: Practice Drills for Trading Ranges: Relief Bars, S/R and GapsMost of the time, when traders look at bars, the question is: “Is this a signal to get in?”But there’s another way to use them. A relief bar is not a signal to enter — it’s a signal to exit. Instead of thinking “BTC/STC” (buy the close / sell the…

-

Continue reading →: ES Trading Stats for Day Traders: Bookmark This!

These are useful stats for day traders (Both scalp and swing traders.) I built a database of charts for the past 5+ years of ES RTH 5 minute data as part of a broader research project. But I have found they work on the other index futures instruments I trade.…

-

Continue reading →: Orlando Workshop: Back to Basics – Docs & Replay

Continue reading →: Orlando Workshop: Back to Basics – Docs & ReplayThanks to everyone who joined the live stream this weekend: Orlando Workshop – Back to Basics + Price Action Coaching Introduction. If you missed it, here’s the replay: (Video loaded to where I start.) During the session, I walked through a couple of documents that are worth revisiting. Below are…

-

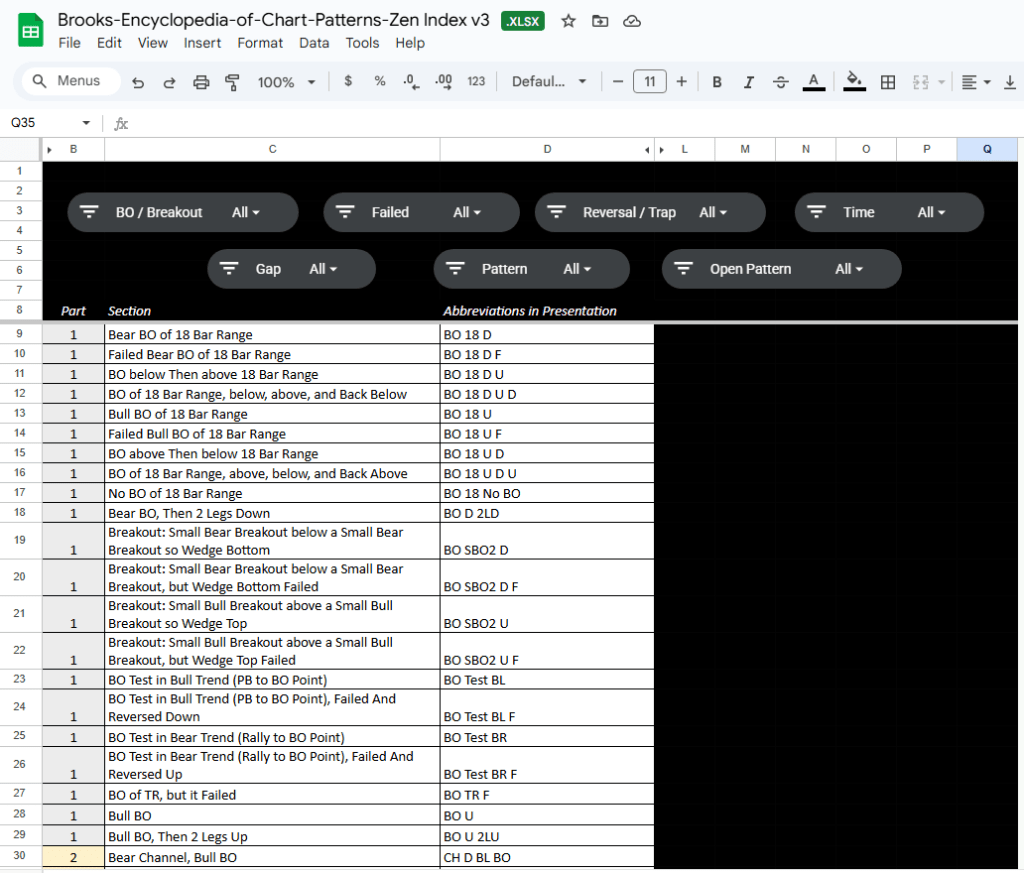

Continue reading →: The Brooks Encyclopedia of Chart Patterns — Now Searchable with Updated Index v3

Continue reading →: The Brooks Encyclopedia of Chart Patterns — Now Searchable with Updated Index v3One of the most requested resources from traders in our community has finally been cleaned up and indexed. If you’ve ever tried to go through Al Brooks’ full Encyclopedia of Price Action, you know how overwhelming it can be — over 7,000 slides across 600+ sections. If you don’t have…

-

Continue reading →: Can We Breathe Our Way to Better Trading? 6 Methods For You to Try

Continue reading →: Can We Breathe Our Way to Better Trading? 6 Methods For You to TrySlightly different kind of post but no less valuable for you, I believe! Over the years, I’ve used seven distinct breathing methods to train my body, sharpen focus, and reset my nervous system. Each one has a clear purpose and method, and I use them in different parts of training—before,…

-

Continue reading →: Consecutive Bars Research

Continue reading →: Consecutive Bars ResearchIntro Indicator Strategy Link here: https://www.tradingview.com/script/WEXwahbE-Zen-CSC-Bar-Strategy-v2/ 5 Consecutive bars, 5min RTH, ES 1/2R Reward 1R Reward 1.5R Reward 2R Reward Notes Idea: Timeframe as a filter – Try on 2min Chart Idea: MA as a filter – BUY ABOVE MA, etc Idea: ES mostly goes up, so just take longs?…

-

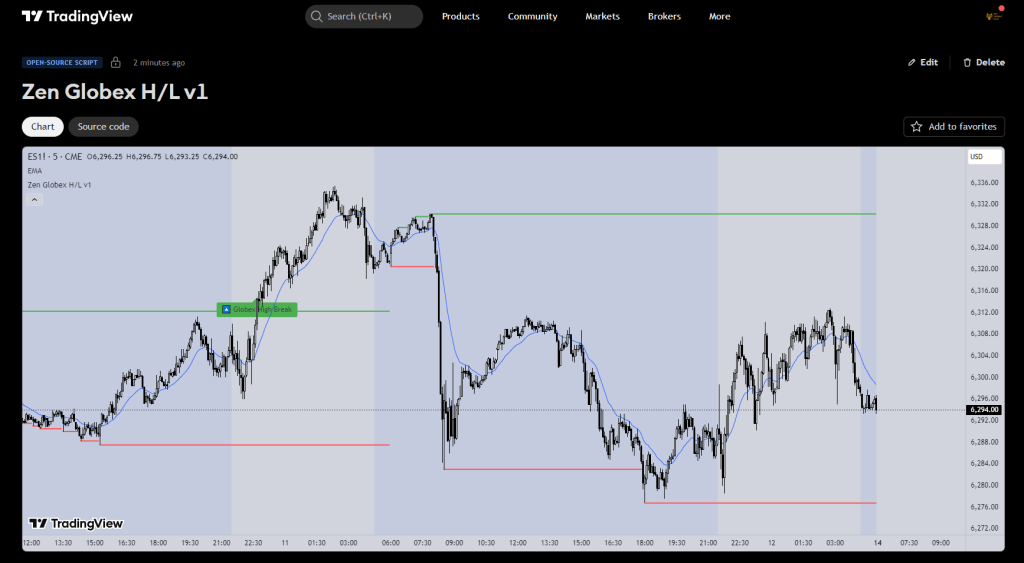

Continue reading →: 🕓 Globex H/L Breaks: A Simple Tool for RTH Session Awareness

Continue reading →: 🕓 Globex H/L Breaks: A Simple Tool for RTH Session AwarenessIf you’re day trading the ES futures or similar products, understanding the relationship between the Globex (overnight) session and the Regular Trading Hours (RTH) session is critical. The Zen Globex H/L v1 indicator is a simple research tool that tracks the Globex High, Low, and Open—and shows you when the…

-

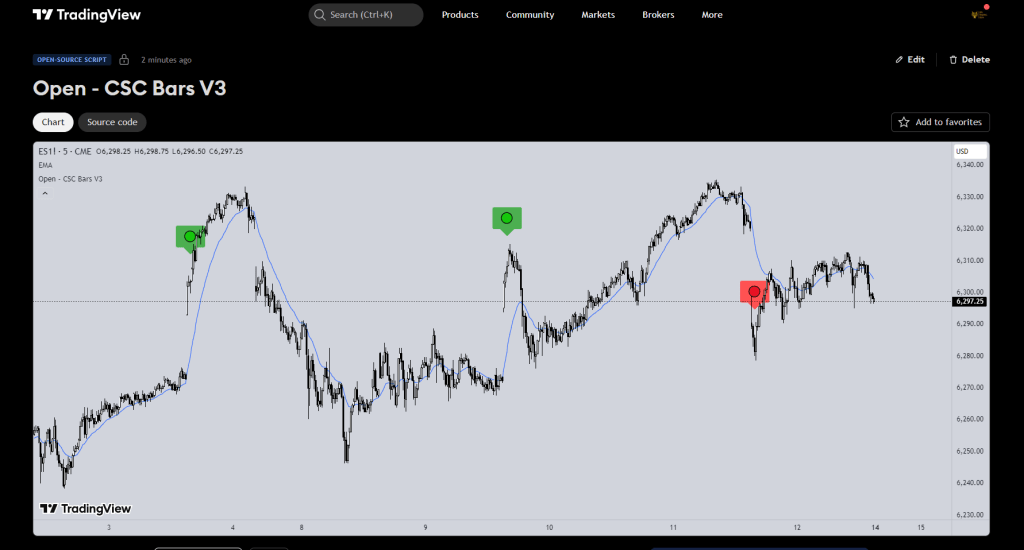

Continue reading →: 🔍 Researching the RTH Open: Consecutive Bull/Bear Bars

Continue reading →: 🔍 Researching the RTH Open: Consecutive Bull/Bear BarsThe open of the Regular Trading Hours (RTH) session is one of the most volatile, emotional, and misleading parts of the trading day. Many traders are drawn to spikes that form in the first few minutes—only to get caught fading strength or chasing weakness. Statistically, a large percentage of opening…

-

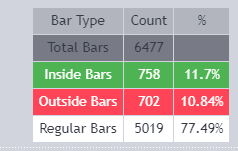

Continue reading →: 📊 Inside/Outside Bars — What They Really Tell Us About Daily Breakouts

Continue reading →: 📊 Inside/Outside Bars — What They Really Tell Us About Daily BreakoutsMost traders know what an inside bar is. Most traders know what an outside bar is. But very few traders actually study how often these patterns show up—and what that might mean for their intraday strategy. I wanted real numbers. So I wrote a simple tool to count them. Here’s…

-

Continue reading →: 🔍 A Simple Visual Tool for Spotting Spikes, Second Legs — and Now, Counter-Trend Reversals!

Continue reading →: 🔍 A Simple Visual Tool for Spotting Spikes, Second Legs — and Now, Counter-Trend Reversals!**Excerpt:** A clean visual tool for spotting momentum bursts, second legs, and now — potential counter-trend reversals. The latest update to the Zen 3CSC script adds an EMA-based filter to isolate exhaustion moves and failed breakouts, making it easier to study price behavior around key turning points. Ideal for traders…

-

Continue reading →: 18-Bar Range: A Simple Tool for Traders Studying the Open of the Day

Continue reading →: 18-Bar Range: A Simple Tool for Traders Studying the Open of the DayBuilt for traders using the Al Brooks Method This free TradingView indicator helps you study how the first 18 bars of the regular trading hours (RTH) session affect the rest of the day. It’s designed to support the kind of market reading taught in the Brooks Trading Course. When you’re…

-

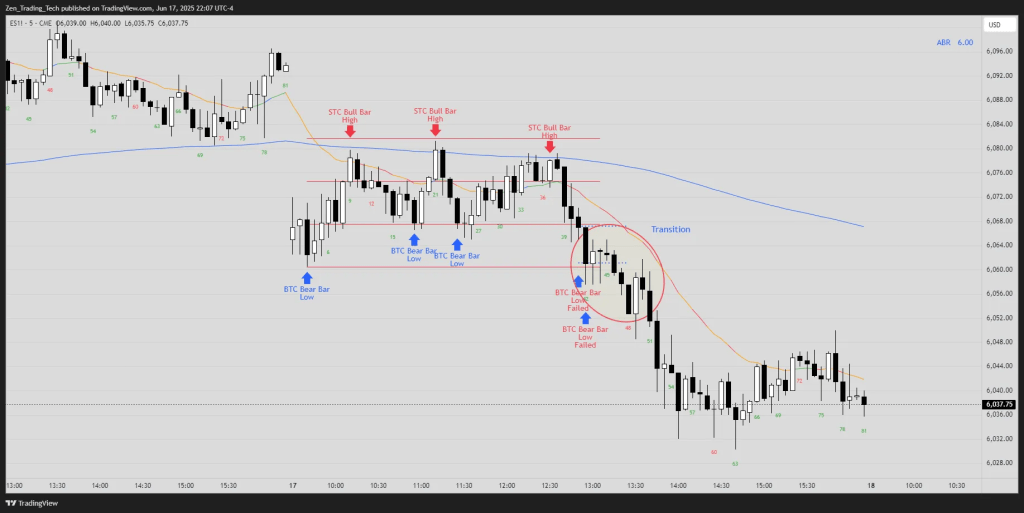

Continue reading →: Trading Range Day – Interesting Practice Drills

Continue reading →: Trading Range Day – Interesting Practice DrillsH1 Failed – L1 Failed https://www.tradingview.com/x/XQjeGXdq/ Skunk Stop / Wide Stop https://www.tradingview.com/x/AkxakO3k/ 2 Bar Reversals https://www.tradingview.com/x/Faszyzzc/ Opening Range Measured Move https://www.tradingview.com/x/Vq1om4AR/ Gap Open – 50% PB, Test MA https://www.tradingview.com/x/2p9lZY5s/ STC BL High > MA / BTC BR Low < MA https://www.tradingview.com/x/cl7tdPx4/ Conclusion Tim

-

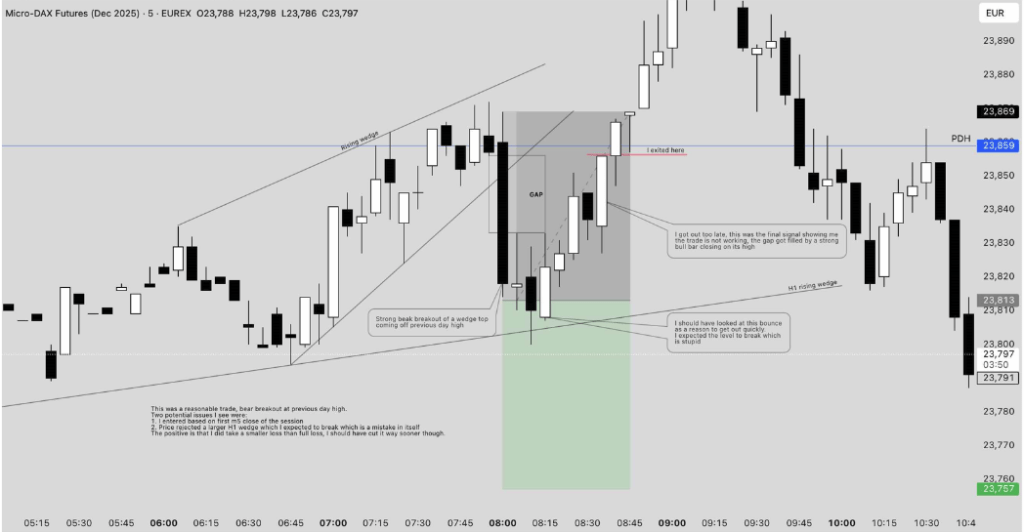

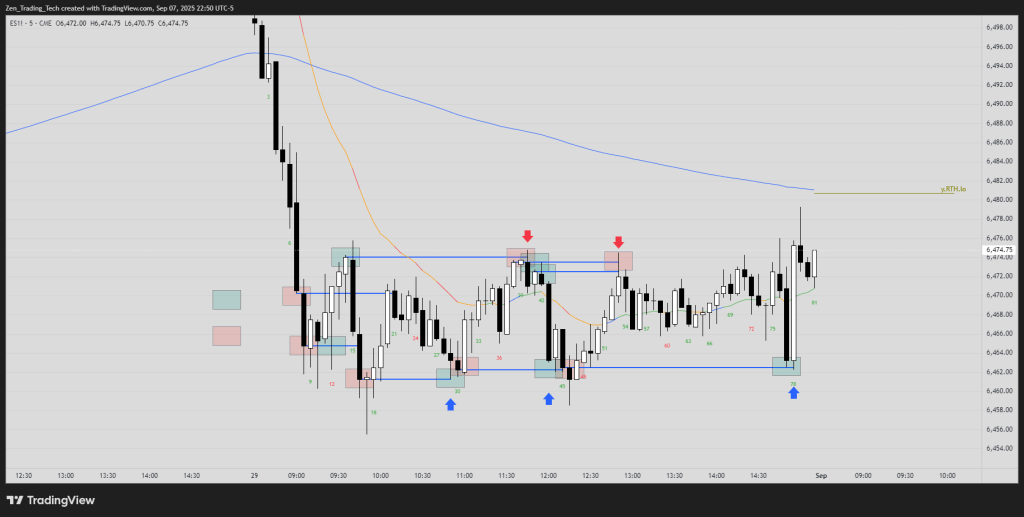

Continue reading →: From Idea to Edge: One Trader’s Process for Setup Research

Continue reading →: From Idea to Edge: One Trader’s Process for Setup ResearchIntroduction I often get asked how I research different setups. I’ve never actually written out my process before—this is my first go. What I’ve shared below is just one way I approach it. It’s not the only way, but it’s helped me turn ideas into something more concrete. I’m not…

Hi,

I’m Tim

Welcome to Zen Trading Tech.

I’m a Aussie day trader and I post trading tips, practice drills, and indicators that helped my trading get to a professional level.

Everything here is to help train the eyes and hands to trade better. If it helped me I’ll post it for others. Hope you enjoy!

Join the fun!

Stay updated with our latest tutorials and ideas by joining our newsletter.